As you navigate the complex world of personal finance in 2024, your credit score remains a crucial indicator of financial health. Whether you’re planning to secure a mortgage, finance a vehicle, or simply aim for better interest rates, a robust credit score is essential. Enter Credit Sesame, a powerful tool designed to help you boost your creditworthiness. This innovative platform offers a comprehensive approach to credit monitoring and improvement, providing you with personalized insights and actionable strategies. In this article, we’ll explore how Credit Sesame can be your ally in achieving a higher credit score, paving the way for enhanced financial opportunities and peace of mind.

Understanding Your Credit Score

Your credit score is a crucial financial metric that can significantly impact your financial opportunities. This three-digit number, typically ranging from 300 to 850, serves as a snapshot of your creditworthiness.

Components of Your Credit Score

Your credit score is calculated based on several factors:

- Payment history (35%)

- Credit utilisation (30%)

- Length of credit history (15%)

- Types of credit accounts (10%)

- Recent credit inquiries (10%)

Understanding these components can help you identify areas for improvement.

Importance of Regular Monitoring

Regularly checking your credit score is essential for maintaining good financial health. Credit Sesame offers free monthly updates, allowing you to track changes and spot potential issues quickly. By staying informed, you can take proactive steps to address any negative factors affecting your score.

Interpreting Your Score

Generally, scores above 700 are considered good, whilst those above 800 are excellent. However, it’s important to remember that lenders may have different criteria for what they consider a ‘good’ score. Credit Sesame provides personalized insights to help you understand where your score stands and how it compares to others in your demographic.

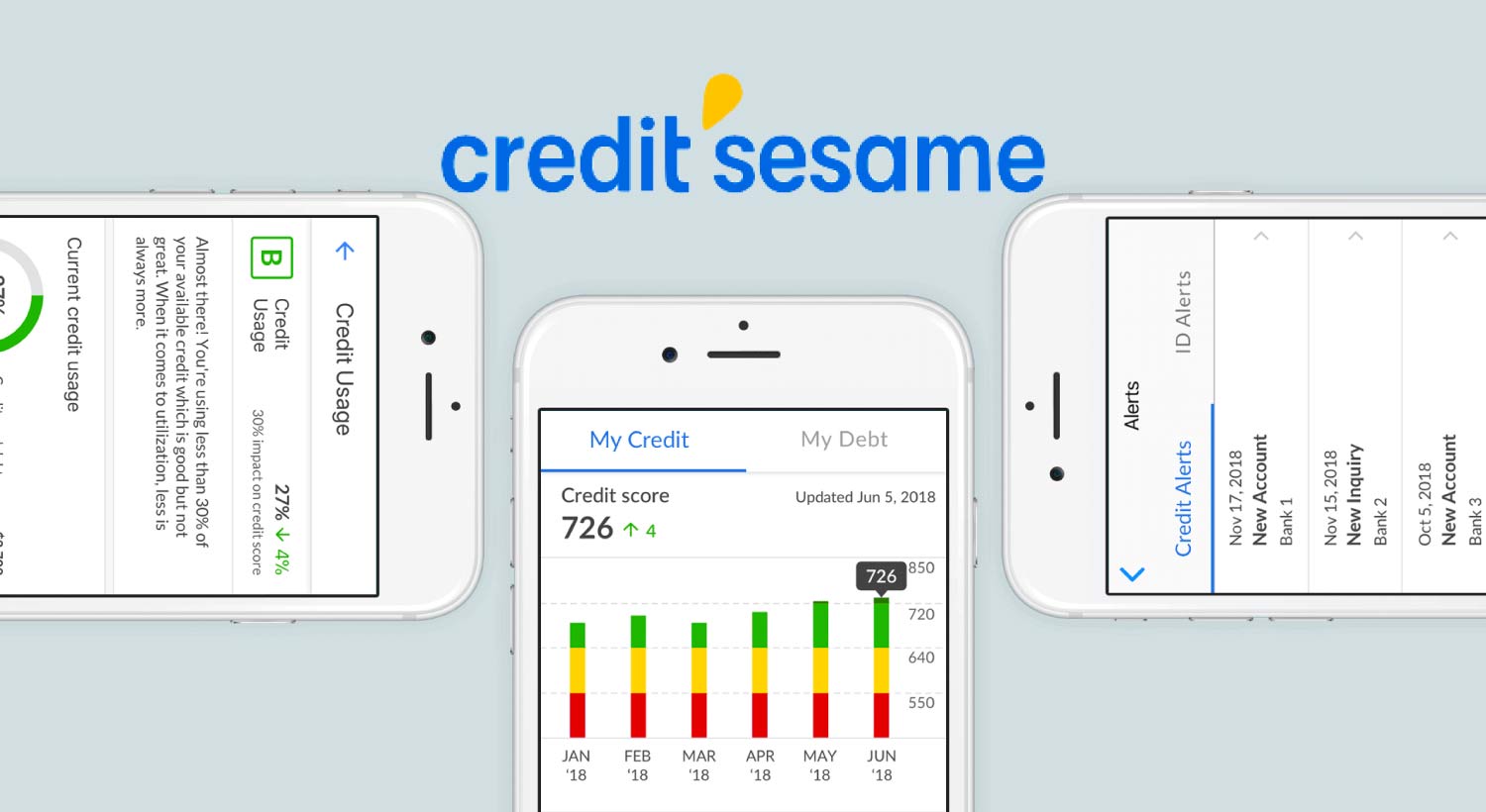

How Credit Sesame Helps Monitor and Improve Your Credit

Credit Sesame serves as a powerful tool for monitoring and enhancing your credit health. This user-friendly platform offers a comprehensive suite of features designed to give you a clear picture of your financial standing and guide you toward better credit practices.

Real-time Credit Monitoring

Credit Sesame provides you with real-time alerts about changes to your credit report. You’ll receive notifications about new accounts, late payments, or suspicious activity, allowing you to address potential issues promptly. This vigilant monitoring helps protect you from identity theft and keeps you informed about factors affecting your credit score.

Personalized Recommendations

Based on your unique credit profile, Credit Sesame generates tailored recommendations to improve your credit score. These suggestions might include reducing your credit utilization ratio, diversifying your credit mix, or addressing negative items on your report. By following these personalized tips, you can make informed decisions to boost your creditworthiness over time.

Credit Score Tracking

With Credit Sesame, you can easily track your credit score’s progress. The platform provides regular updates, allowing you to see how your financial decisions impact your score. This feature motivates you to maintain good credit habits and celebrates your improvements, fostering a positive approach to credit management.

Top 7 Tips to Boost Your Credit Score with Credit Sesame in 2024

1. Monitor Your Credit Regularly

Utilise Credit Sesame’s free credit monitoring service to keep a close eye on your credit report. Regular monitoring allows you to spot errors or fraudulent activities promptly, enabling swift corrective action.

2. Dispute Inaccuracies

If you notice any discrepancies in your credit report, use Credit Sesame’s dispute feature to challenge these inaccuracies. Removing erroneous negative items can significantly improve your credit score.

3. Maintain Low Credit Utilisation

Aim to keep your credit utilization ratio below 30%. Credit Sesame provides insights into your current utilization, helping you manage your credit card balances effectively.

4. Set Up Payment Reminders

Leverage Credit Sesame’s payment reminder feature to ensure you never miss a due date. Timely payments are crucial for maintaining a healthy credit score.

5. Diversify Your Credit Mix

Credit Sesame offers personalized recommendations for credit products that could enhance your credit mix. A diverse credit portfolio can positively impact your overall score.

6. Keep Old Accounts Open

Resist the urge to close old credit accounts, as they contribute to your credit history length. Credit Sesame’s analysis tools can help you understand the impact of account closures on your score.

7. Use Credit Sesame’s Score Simulator

Experiment with different financial scenarios using Credit Sesame’s Score Simulator. This tool allows you to forecast how specific actions might affect your credit score, enabling informed decision-making for your financial future.